Trading in the stock market can be the coolest way to build your wealth, but trading comes with high risk, So if you wanna reduce risk you have to grab knowledge, strategy, and discipline. If you are Beginner to trading and curious to know where to start .This Article will provide you a step by step guide to learn and understand the basics of the stock market.

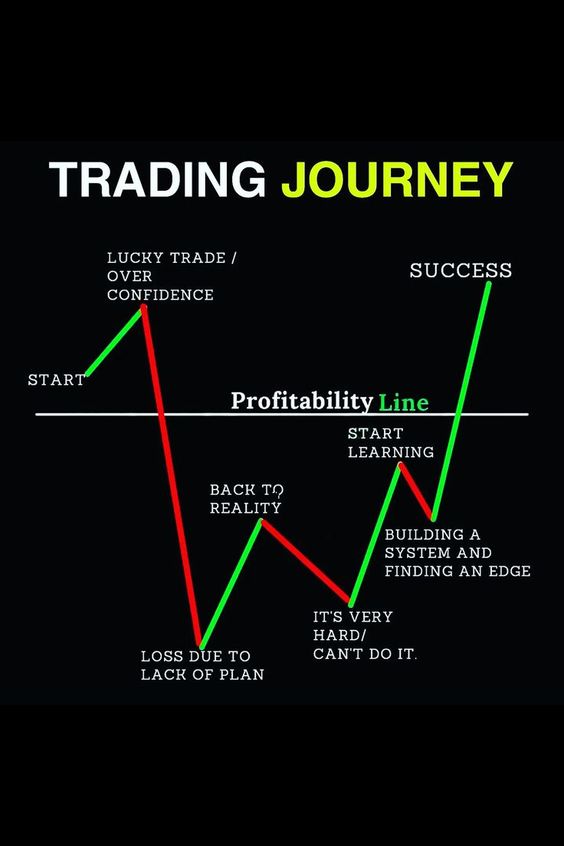

Now, Be Ready to start your wonderful and a roller coaster Journey of Trading.

1. Understanding the Basics of Stock Market

First we have to learn the Basics or we can say key terms of the stock market.

- What is the Stock Market?

Stock Market is a Marketplace where we can buy and sell the shares of publicly listed companies. It is used to raise capital for expansion and sharing risk with a large number of people so that one person doesn’t have to bear all risk.

Stock Market provides a platform for listed companies to raise capital to boost business and share the risk among investors.

- Key Terms in Stock Market:

- Stocks/Shares: Stocks(equity/shares) represent the owner’s share in a company.

- Bonds: Bonds are Issued by Government and Companies when they want to raise money in exchange for interest.

- ETFs (Exchange-Traded Funds): AN ETF is a collection of securities that trade on Exchange and tracks on a specified Index.

- Mutual Funds: A pool of investments managed by Professionals, those funds are invested in the stock market in a Diversified manner, So that risk is Minimum.

- Market Orders and Limit Orders: A market order buys or sells a stock at the current market price, while a limit order sets a specific price for the trade.

- Stop-Loss Orders : An order to sell a stock when it reaches a certain price to prevent losses.

2. Set Financial Goals and Manage Risk

- Before you start a Trading Journey in the stock market, define your financial goals like what is your target in stock market trading like short-term profits, long-term capital gain or Daily Profits? Knowing your trading style will help you choose the marketing strategy that’s right for you.

- Risk Capacity: Understand how much Maximum risk you can take in one trade/one day/one month. If you are scared from taking risk avoid options, invest in safe investments or strategies and firstly focus more on learning. Your risk management will guide your trading decisions.

3. Choosing the right trading strategy

The trading strategy you may choose should match your risk capacity, financial goal and time available for trading. Here are some of the most common ways to trade:

- Day Trading: Buying and selling securities(shares,Derivatives,ETfs…) on the same trading day to grab small price movements. This strategy requires quick decisions to book your profit or loss. It’s very risky to trade daily.

- Swing Trading: Holding trade positions for a few days to weeks to take profit from medium-term trends. Swing Trading is usually based on technical analysis and takes less time than day trading.

- Position trading: Holding stocks for months to years to take long term advantages. This strategy is mostly based on Fundamental with technical analysis.

- Scalping: Scalping in stock market is the type of day trading in which many small-small trades take place throughout the day in order to make a profit.It is very risky and it requires more attention and fast execution.

4. Choosing a trustworthy brokerage and opening a trading account

To start trading, you will have to open a Demat/Trading account with a stockbroker. Choose a broker that fits your trading style, offers an easy-to-use platform, and offers Discount rates.

- Full-service Brokers: They provide a wide range of services like market research, consulting and portfolio management.

- Discount Brokers: Discount Broker have lower brokerage rates but lesser services. Suitable for selected traders who are comfortable making their own decisions.

5. Learning the Essentials: Technical and Fundamental Analysis

The two main methods of analyzing stocks are fundamental and technical analysis. By mastery in these two factors you can succeed in your investment journey.

A. Fundamental Analysis

Main assessment points include the company’s financial reports, growth potential, management team, competitive position and industry trends.

Key features include:

Financial Statements: Examine balance sheets, income statements, and cash flow statements to evaluate profitability, liquidity, and growth potential.

Value Ratio: Metrics such as price-to-earnings (P/E), price-to-book (P/B), and debt-to-equity (D/E) ratios help determine whether a stock is overvalued or undervalued.

Earnings reports and guidance: Understand the company’s earnings and understand future planning of companies growth on quarterly and annually basis..

B. Technical Analysis

Technical analysis involves analyzing past price data and quantifying trading volumes to predict future price trends.

The main features are:

Price Images: Candles, bars, and images are often used to display prices.

Indicators and Oscillators: Tools such as Moving Averages, Relative Strength Index Moving Average Convergence Divergence (MACD) and Bollinger Bands help. Let t t t traders identify possible entry and exit points…

Support and Resistance Levels: Price points at which stocks have historically tended to fall behind or face increased resistance.

Chart Patterns: Patterns such as Head and Shoulders, Double Top Down. and triangle It indicates the possibility that the price will reverse or continue.

6. Developing a Robust Trading Plan

A Trading plan is a structured approach that outlines your financial goals, risk management, and business rules. A solid business plan should include the following:

- Financial Goals: Define your short-term and long-term goals.

- Risk Management rules: Limit your risk per trade (e.g., 1-2% of your total capital) and set stop-loss levels to prevent potential losses.

- Entry and exit criteria: Establish trade entry and exit criteria based on technical and/or basic analysis.

- Position Sizing: Decide how much money to allocate to each project to ensure diversity and manage risk.

7. Practicing with a Demo Account

Before trading with real money, practice with a demo account offered by most brokers. This will help you:

- To Understand the trading platform.

- Test your trading strategies without risking your real hard earned money.

- Build confidence in Trade and understand how the market flows.

8. Executing Your First Trade

When you feel confident and ready, start the project with a small budget. Choose stocks or other assets you understand well. Follow these steps:

- Research and Analysis: Use basic and technical analysis to identify potential business opportunities.

- Set up a trade: Place the appropriate orders (market, limit, stop loss) in the trade.

- Monitor the trade: Constantly monitor the trade, using stop-loss and profit-taking orders to manage risk.

- Review the results: Review your business and understand whether you are making a profit or a loss, what went right or wrong and adjust your process accordingly.

9. Advanced Trading Strategies

Once you’ve mastered the basics of The Stock Market, consider adding more advanced techniques to your Trading Strategy

A. Options Trading

Options trading is a type of financial trading that allows us to buy and sell an underlying asset at a fixed price at a future date.

- Covered Call: Covered Call is Option Trading Strategy Sell call options of a stock that you Already Own.

- Protective Put: Protective Put is Option Trading Strategy Buying a Put options of a stock that you Already Own.

- Iron Condor: A strategy for buying and selling options at strike prices to take advantage of low volatility.

B. Future trading

A future is a fixed contract to buy or sell an asset at a fixed price on a specified date. This type of trading is typically used to hedge or speculate on prices, currencies, or indices.

- Long and short positions: Go long if you expect the price to rise, or short if you expect it to fall.

- Hedging: Provide future protection against price fluctuations in commodities or securities.

C. Algorithmic trading

Algorithmic trading uses automated systems and algorithms to execute trades based on predefined criteria. It offers benefits such as speed, accuracy and the ability to track historical data trajectory.

High-Frequency Trading (HFT): Many trades are made in seconds to take advantage of small changes in prices.

Trend Following: The algorithm identifies and executes trades based on technical signals.

Market Making: Algorithms buy and sell securities to make money and profit from bid-ask spreads.

10. Risk Management and Business Psychology

Even the best strategies will fail without proper risk management and operational discipline. The basic principles include:

- Diversification: Spread investments across different assets, sectors, or geographies to reduce risk.

- Position Sizing: Assign an appropriate amount of capital to each business based on your risk capacity to lose money.

- Stop-loss orders: Always use stop-loss orders to limit losses.

- Mental discipline: Emotional trading decisions motivated by greed or fear. Stick to the plan and have a cool mind.

11. Continuously Learning and Adapting

The Stock Market is dynamic, and ongoing learning is essential for long-term success.

Follow the following points to win the market.

- Market News and Trends: Follow Stock Market news, financial news, earnings news, and geopolitical events affecting markets.

- New strategies and tools: Learn new signals, algorithms and ways to improve your trading skills.

- Evaluate and improve: Regularly review your performance to identify areas for improvement and change your strategies accordingly.

Conclusion

Starting to trade in the stock market requires knowledge with patience, a well-defined strategy, and the discipline to manage risk and control emotions. By understanding the basics, a strong trading system is developed. By practicing it regularly you can slowly move from beginner to advanced trader. Remember that the key to a successful career is persistence, patience and a commitment to improvement.

” Always Be a learner,Don’t Chase Market – Only Follow the Market”.

Happy Trading!